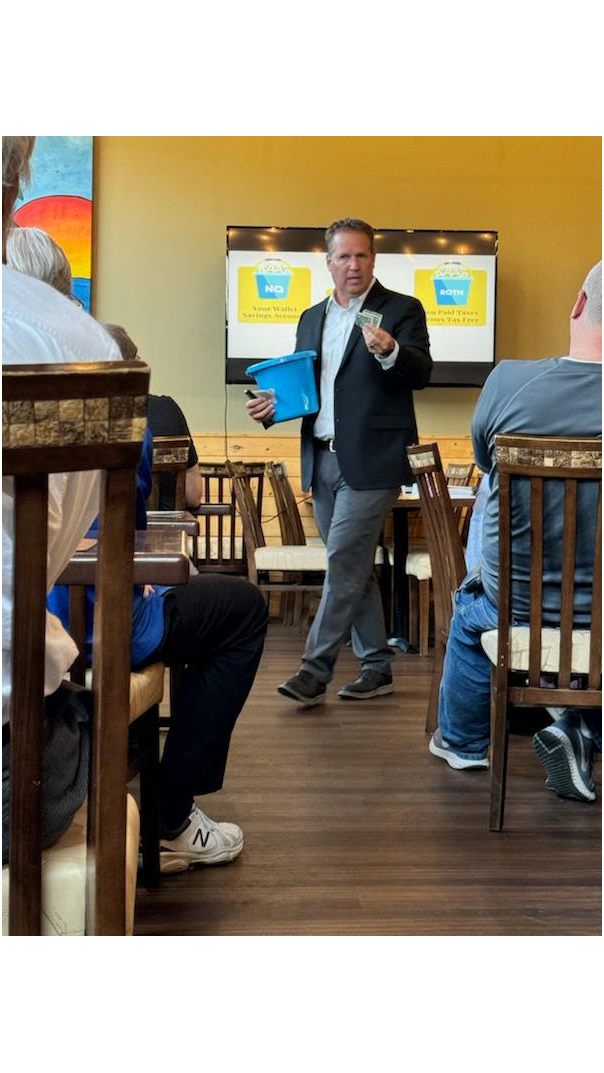

Craig Judd: Utah Financial Advisor For Retirement & Tax Planning With Low Fees

If you're thinking about retirement and weighing up your options for growing a sizable nest egg, it's easy to get distracted and swayed by promises of so-called guaranteed returns and lavish lifestyles in your later years. Smart Financial keeps it simple with services you can bank on.

Put your financial future in safe hands by working with Craig Judd. There's finance and then there's Smart Financial – make the smart choice. More details at https://craigjudd.com

Low Fees

Craig and his company Smart Financial offer you a different approach to financial planning. By focusing on reducing fees as well as building a strong portfolio, they allow you to hold onto more of your funds and grow a larger pot for your golden years.

Let's Get Real

Craig Judd and the Smart Financial team believe, despite marketing claims that state otherwise, no financial planners can guarantee you returns over the average market return of 10% per year which equates to 7% when adjusted for inflation.

“Even that isn’t a guarantee—it’s just a reliable expectation if the last century is any indication,” Craig explains. “If someone does guarantee anything above that, they’re guessing at best or fraudulent at worst.”

Social Security Strategies

In addition to offering some of the lowest fees in the industry, Smart Financial's approach also entails generating more funds from sources like social security. The company says that it typically helps clients earn an extra $200 per month from social security benefits. Who couldn't use an extra couple hundred bucks every month?

Rather than leaving you to work out how to maximize income from social security and tax planning, Craig Judd and Smart Financial coordinate these elements to ensure optimal returns and minimal liabilities.

Craig adds, “We keep Social Security, tax planners, ROTH conversion, and other retirement experts on staff to make sure no rock is left unturned when it comes to protecting and maximizing your retirement money. We even pay $16,000 for the latest financial software to ensure we’re making the smartest decisions on your behalf.”

Succession

Another unique aspect of the company's retirement planning approach is succession contingency. Craig explains how most financial planners end up gaining a promotion or moving offices or locations, leaving you struggling to find a replacement who will continue the work they've started. At Smart Financial, successors are already being trained so they can take the reins at short notice.

Breaking Taboos

The company prides itself on asking difficult questions about retirement and having plans in place if you or a loved one gets sick or dies unexpectedly.

“Death and retirement shouldn’t be taboo,” says Craig. “I answer the questions you should be asking to ensure you have the most stress-free and maximum amount of money possible.”

Expertise & Infrastructure

Smart Financial is a certified Charles Schwab broker, leveraging a long-established and robust financial infrastructure and expert advice from a veteran of the industry.

Face your financial future with confidence by working with Craig Judd & Smart Financial!

For more info, go to https://craigjudd.com

Craig Judd

City: Provo

Address: 350 E Center Street #100

Website: https://www.craigjudd.com

Comments

Post a Comment